October 31, 2024

2 minute read

Tag(s):

Financial Services

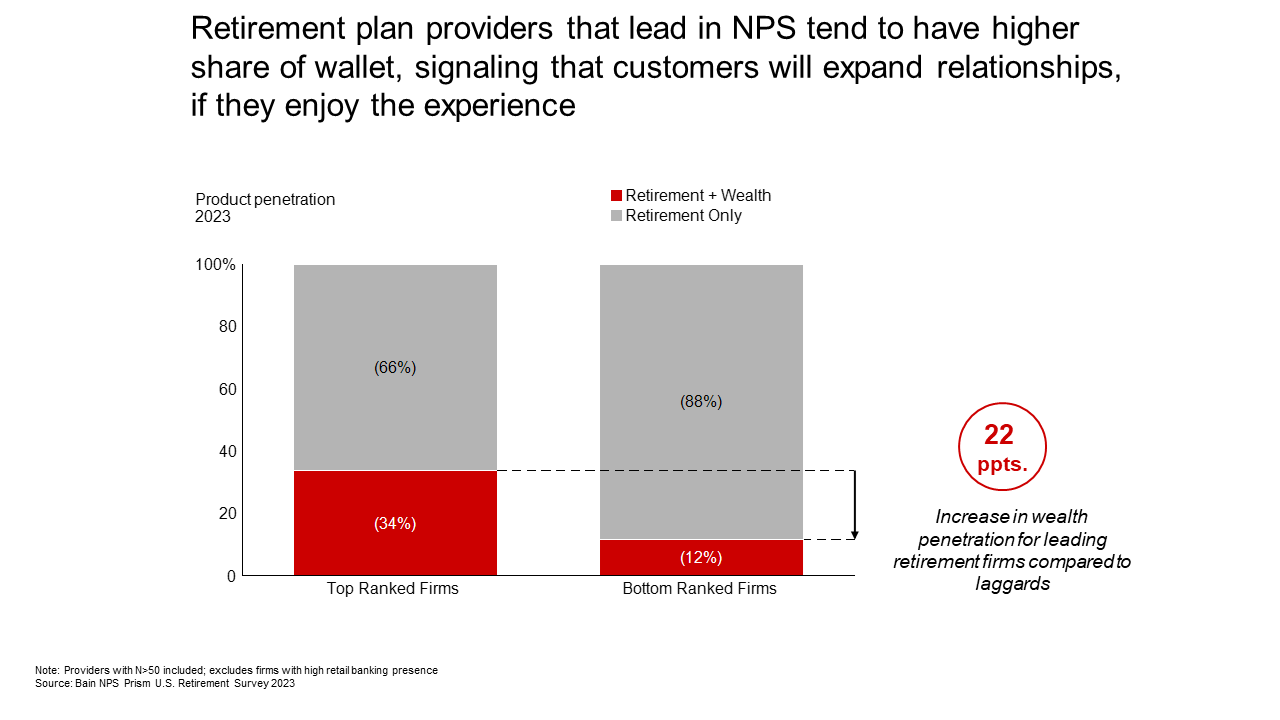

New data from NPS Prism shows that retirement providers leading in NPS earn a significantly higher share of wallet compared to lagging firms. At top-ranked firms, 34% of retirement clients expand their financial relationship by purchasing wealth management products, while only 12% of clients at lower-ranked firms do the same. This 22% difference highlights a clear link between high customer satisfaction and long-term financial loyalty.

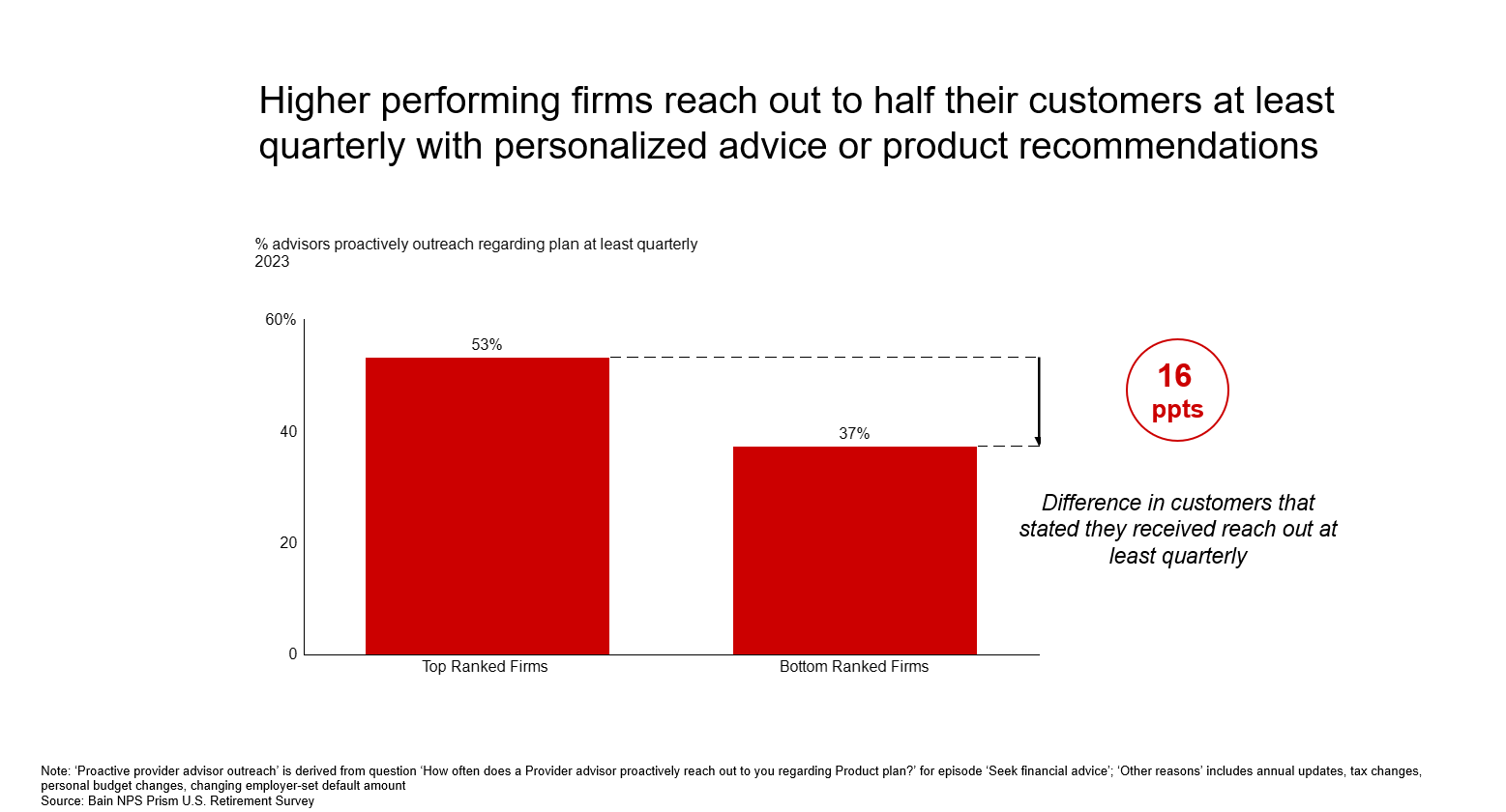

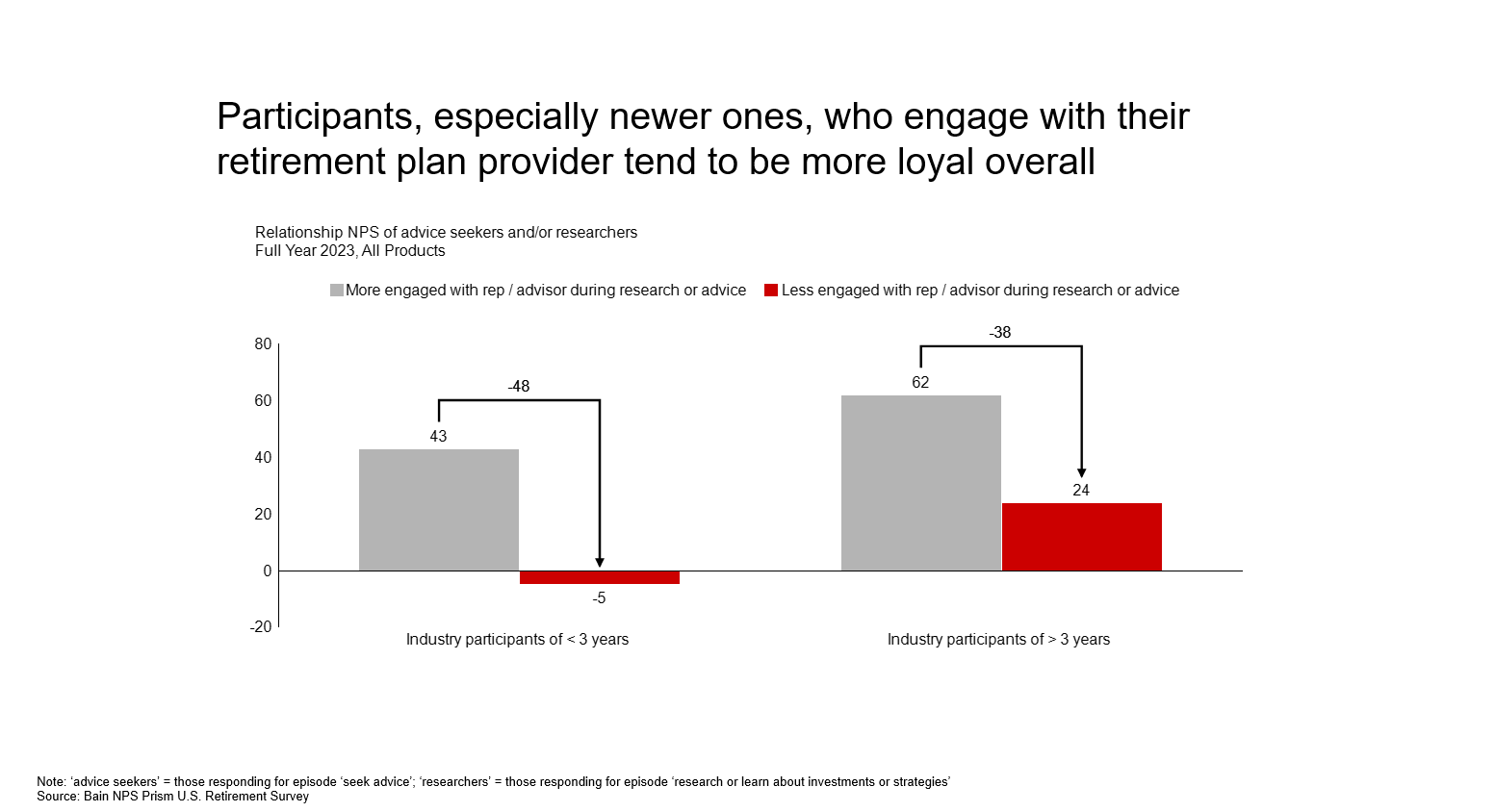

So, how can retirement providers boost NPS? A key factor is personal engagement with their retirement provider, particularly for new participants. Clients who receive personalized advice and make changes—like adjusting contributions—tend to be happier. Notably, 53% of advisors at top-ranked firms proactively reach out to clients at least quarterly, compared to 37% at lagging firms. These firms also see three times more customers making changes based on advisors’ recommendations.

Additionally, frequent engagement fosters a sense of care. Firms that regularly connect with participants see 2-3 times more customers feeling their provider is invested in their financial well-being. On the flip side, less engaged customers tend to penalize firms in NPS, especially within the first three years of the relationship. Those who engage early with their provider typically see around a 30-point higher NPS than those who don’t.

Schedule a personalized discovery session to explore our platform and gain never-before-seen NPS insights based on thousands of financial services customers, with competitive analyses curated just for your business.

Subscribe to our blog to learn about all the major industry trends revealed by NPS Prism data.